When Amazon announced it would enter the Dutch e-retail market, it sparked concerns among e-retailers in the Netherlands. Their main question: 'How will it impact our sales?' To find the answer, let's have a look at the current e-retail market and discuss possible developments after Amazon starts competing with top e-retailers in the Netherlands.

What strategy will Amazon probably adopt?

As a platform, Amazon can and definitely will invest heavily in optimizing its online shopping experience so as to build customer loyalty. To this end, it will likely offer low effort (mobile shopping, personalization, same-day delivery) and low risks (service, insurance, return policies). By providing a better shopping experience, platforms can constantly add ever-difficult product categories to its range and win more customers.

What does the Dutch market currently look like?

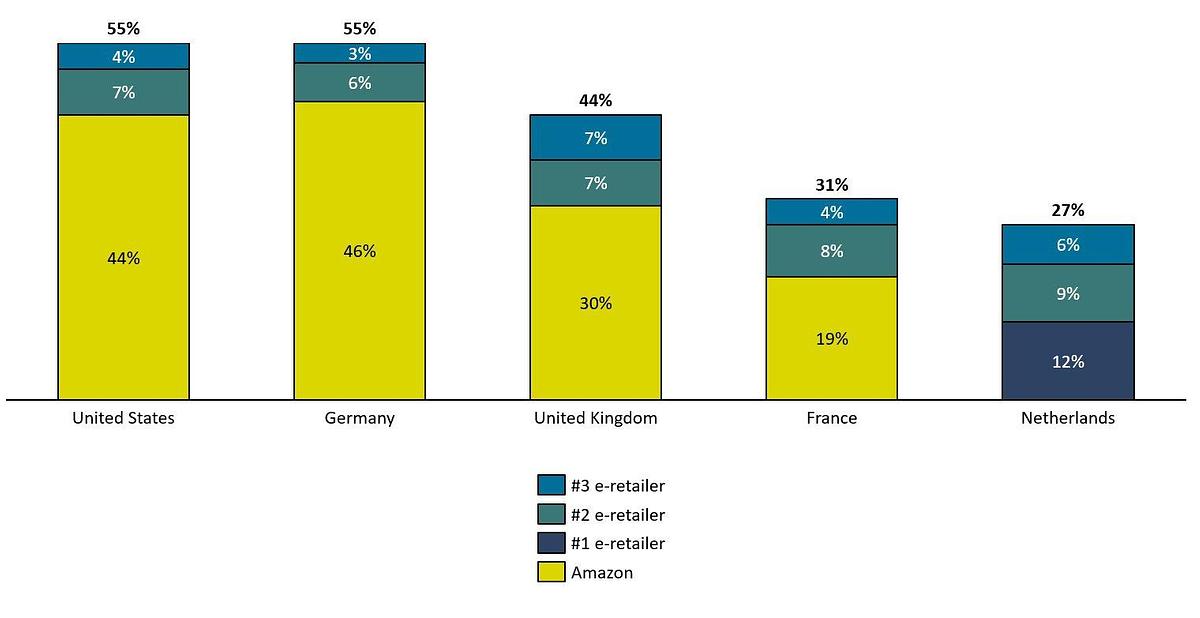

In the past decade, Amazon has entered several European countries, including Germany, France, and the UK. In most countries, it has become the dominant platform with a market share of at least 19% (*1). However, the current Dutch market share of top e-retailers looks more fragmented: together, the top 3 players cover a market share of 27%. This means it's unlikely Amazon will take over half of the Dutch e-retail market, as some fear.

According to Sprout, 40% of the Dutch e-retail market consists of 10 e-retailers, such as bol.com, Coolblue, and Zalando. How can we explain this high level of fragmentation? Well, the Dutch are characterized by their category-based shopping behavior. Traditionally, the European retail market is made up of product category-oriented shops that offer a best-in-class shopping experience for both online and offline sales. It's the exact opposite of the situation in the US, where all products are bought in malls or chains such as Walmart. By way of comparison, department stores like V&D and Hudson's Bay haven't managed to keep their head above water in the Netherlands. The Dutch prefer a different approach: they buy clothes at Zalando or H&M, electronic devices at Coolblue or Mediamarkt, cosmetics at ICI Paris, and food at grocery stores such as Albert Heijn.

What's the most likely scenario?

Considering current trends, we expect a switch in consumer preference from product category- to lifestyle-oriented online shops that are closely intertwined with (social media) apps. Although product category-oriented online retailers will continue to exist for some advisory-dense categories (such as medicine and pet food), most new online shops will focus on lifestyle and be social media driven. By turning shopping into a social activity, they'll gain consumer loyalty. New apps such as Countr are springing up, relying on social commerce as their core business. Lifestyle-oriented online retailers will replace product category-oriented (online) retailers that offer a best-in-class shopping experience.

However, the switch in consumer preference doesn't mean there will be less space for platforms in the Netherlands compared to other Western countries. Web shops specializing in niches will continue to exist because of fragmented consumer buying behavior, which is why there will be a relatively small share for platforms. This means the most interesting question is whether there will be room for two large platforms: Amazon and bol.com.

Amazon: good news for consumers

One thing's for sure: Amazon's entrance into the Dutch market is shaking up the world of e-commerce. That might be good news for the consumer. Dutch e-retailers, such as bol.com, Coolblue, and Wehkamp, will go out of their way to keep their head above water, which will affect product prices, customer service, and shopping experiences. Amazon has arrived in the Netherlands, and we're looking forward to seeing how Dutch consumers will behave and what it might bring us!

Interested in platforms and their successes? Read my co-worker Gijs’s blog, The rise and success of digital platfoms.

*1 Source: “Nieuwe strijd staat voor de deur in online retail”, ING Economisch Bureau – January 2019, Page 12