First it was ‘just’ Covid-19 and climate change. Now, a third crisis is dominating the news: inflation. Energy prices are skyrocketing, and as a result, food is rapidly getting (prohibitively) expensive. The impending recession threatens to get many people into trouble.

So, it’s high time to analyze and anticipate people’s behavior. How do we spend our money today? How will our expenses change? In which cases will they increase? And how can businesses respond to all of this?

How did we spend our money in the pre-inflation era?

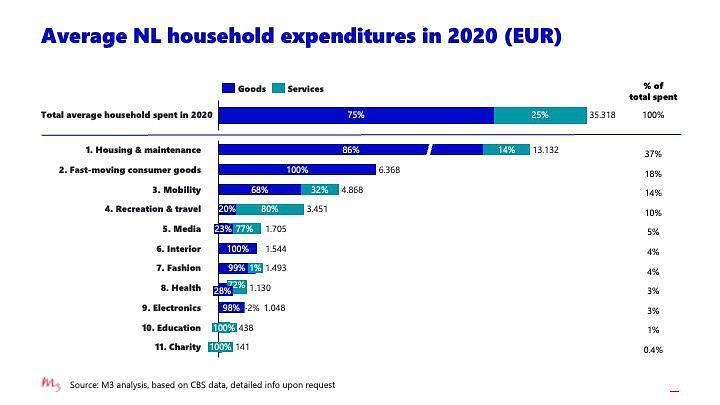

Statistics Netherlands (CBS) keeps detailed track of how Dutch households spend their money. Being consultants at heart, M3 Consultancy created its own categories [LK1] [MOU2] based on this data, breaking down costs according to the purchasing of products (such as cell phones) and services (like cell phone plans). You can see how a total of 8 million households spent their money in 2020 in the figure below.

It can be interesting to engage in some self-reflection to see where you stand. What were your expenses two years ago? What category did your household spend relatively more or less money on?

Crisis 1. Inflation: putting pressure on our basic needs

To create a similar overview for 2022 or 2023, we need to evaluate how inflation impacts the share of money spent on each category. Currently, inflation is mainly driven by high energy prices, thus directly impacting ‘housing & maintenance’ (1) and ‘mobility’ (3). But it indirectly affects all other categories. After all, you need energy to manufacture all goods, and all external (Dutch) facilities you use have to turn on the heating system in winter (e.g. a library). However, the correlation between the energy and consumer prices varies per category. And not all prices are raised simultaneously — in some categories, it takes longer than in others for prices to be affected.

Rabobank thoroughly investigated how energy prices relate to these different spending categories. If we have a closer look at the indirect effects, the category that is impacted most significantly by the high energy price is ‘fast-moving consumer goods’ (2) — or, our food. And that hasn’t gone unnoticed. For who hasn’t been affected by more expensive groceries?

Other categories where rising energy prices are definitely felt (in decreasing order) include:

- 6: ‘Interior’ (household supplies)

- 9: ‘Electronics’ (household appliances)

- 7: ‘Fashion’ (shoes)

So, there’s less money left for things like ‘recreation & travel’ (4) and ‘media’ (5). The latter include video streaming services, among other things.

Crisis 2. The pandemic: permanent changes in our spending patterns

In some ways, the Covid-19 crisis has permanently affected our spending patterns. According to a McKinsey report, three shifts can be observed in this regard.

First, we’ve collectively switched to remote working during the pandemic. But the concept is here to stay, and it has led to a rise in ‘home nesting:’ as people spend more time in and around the house, they spend money on items and equipment to increase comfort levels. While remote working usually isn’t an option for low-income households, the home nesting trend is also observed there. After the pandemic, for example, they will likely continue to use low-cost at-home alternatives to a night out, such as digital entertainment. This mainly increases expenses in the following three categories: ‘housing & maintenance’ (1), ‘interior’ (6), and ‘electronics’ (9).

Second, many people have paid more attention to maintaining good health (category 8 in figure 1) in the past two-or-so years. In an attempt to prevent catching Covid-19, they have purchased health products and services on a massive scale. This consumer behavior trend is expected to continue in the post-Covid-19 era.

Third, e-groceries are likely here to stay as well. However, this trend will only cause a shift within category 2, FMCG, as people spend a bit more money on the service to have their groceries picked, packed, and transported to their homes.

Crisis 3. Climate change: from products to services

And then there’s the third crisis: climate change, which is likely the most impactful of all three — especially in the long term, as no one can confidently predict its outcome. Environmental awareness and concerns keep increasing, thus changing our purchasing behavior.

Here’s one of the most visible trends in this regard: the focus of our expenditure is shifting from products to services. The sharing economy — supported by the myriad of platforms that continue to pop up — reduces the need for constantly buying new stuff.

We also try to become more circular by reusing, refurbishing, and repairing items whenever we can. That attempt is encouraged by EU legislation on the right to repair, among other things. This trend is already quite common in some categories, such as ‘mobility’ (3), ‘interior’ (6), and ‘fashion’ (7).

In conclusion: how should businesses respond to our changing world?

A well-known mantra in business is, ‘Know your customer.’ If you’re familiar with your customers’ needs and preferences, you can spot new opportunities and adapt your business in a timely manner whenever required.

You might want to ask yourself questions such as:

- Is the pricing level of my products still feasible now that households can spend less money in my category?

- Do I have the option to expand my product portfolio into categories people value more these days, like health products?

- Can my business offer a repair service?

As you can see, monitoring consumer trends is definitely worth the effort. It will help you adopt an agile mindset, which is indispensable for businesses in today’s volatile world.